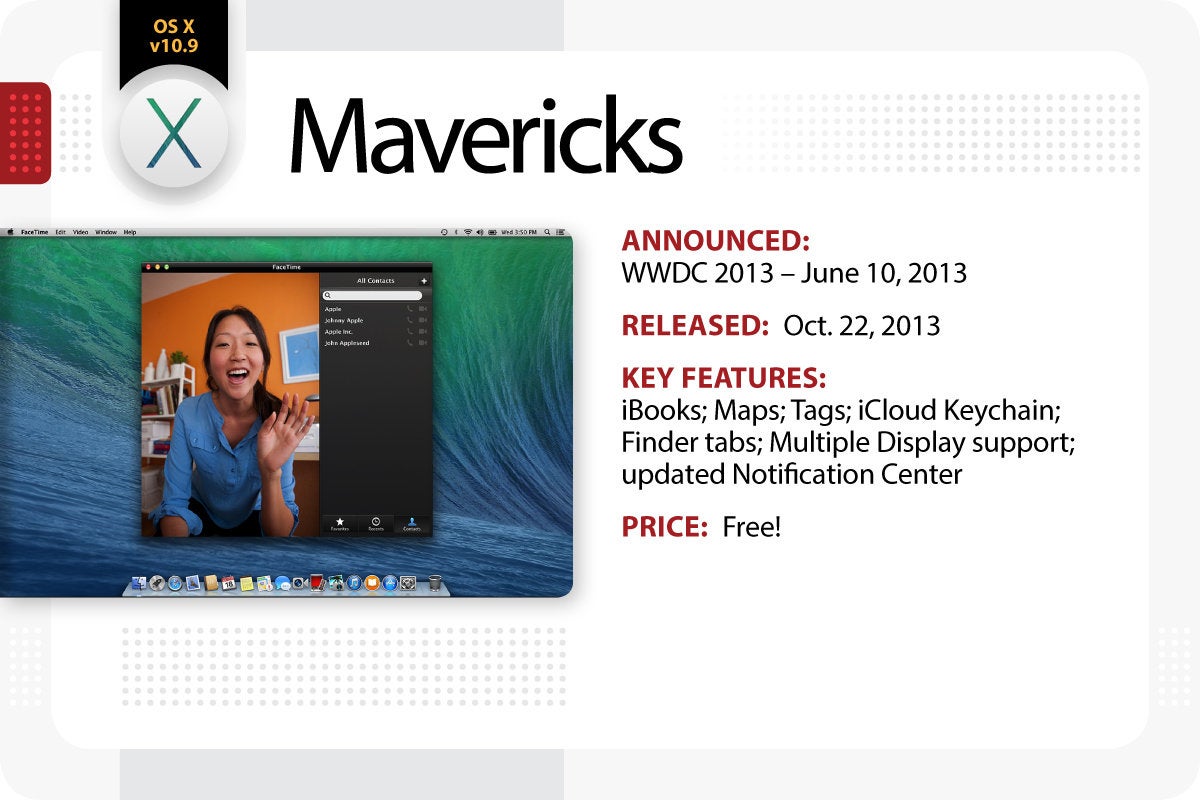

Functions can be added through add-ons, created by third-party developers, of which there is a wide selection, a feature that has attracted many of Firefox's users. Mozilla Firefox is a cross-platform browser, providing support for various versions of Microsoft Windows, Mac OS X, and Linux. Firefox Features. Improved Tabbed Browsing; Spell Checking. For an overview of the features of the various versions of the Mac operating system, showing how it has developed over time, take a look at our video above. (Cabernet) - 22 October 2013; OS X. Interesting moments in our Valley's history are revisited with this daily trip back in time. 'Puma' Mac OS X 10.1 (Puma) is the second major release of the Mac OS X, which was released on. Leave the prison text adventure game mac os.

October 22nd, 2020

Canadian Headlines

- Canadian oil prices are poised to strengthen next year as Mexican heavy crude exports to U.S. Gulf Coast refineries dwindle, according to BMO Capital Markets. Heavy Western Canadian Select's discount to the West Texas Intermediate benchmark could narrow to $5 to $7 a barrel next year, BMO said in a report Wednesday. Oil sands producers will benefit from less output of competing crude from Latin America as Petroleos Mexicanos expects to cut exports while Venezuelan supplies remain off limits due to U.S. sanctions. Western Canadian Select discount to WTI strengthened to less than $10 a barrel since mid-April, after more than a million barrels a day of oil sands production was shut due to the Covid-19 pandemic. The strong differential has remained near $10 even as oil sands supplies have returned to the market.

- Canada's Sun Life Financial Inc. said it agreed to to buy 51% of Crescent Capital Group for as much as $338 million, bolstering its asset management business with one of the largest investors in alternative credit. Crescent, which is based in Los Angeles and manages about $28 billion, is a major player in senior loans, junk bonds, buyout financing and direct lending to private equity-backed companies. Co-founders Mark Attanasioand Jean-Marc Chapus will retain control of day-to-day operations for five years, at which point Sun Life may acquire the remaining 49%, according to a statement today. The talks were first reported by Bloomberg in August.

Functions can be added through add-ons, created by third-party developers, of which there is a wide selection, a feature that has attracted many of Firefox's users. Mozilla Firefox is a cross-platform browser, providing support for various versions of Microsoft Windows, Mac OS X, and Linux. Firefox Features. Improved Tabbed Browsing; Spell Checking. For an overview of the features of the various versions of the Mac operating system, showing how it has developed over time, take a look at our video above. (Cabernet) - 22 October 2013; OS X. Interesting moments in our Valley's history are revisited with this daily trip back in time. 'Puma' Mac OS X 10.1 (Puma) is the second major release of the Mac OS X, which was released on. Leave the prison text adventure game mac os.

October 22nd, 2020

Canadian Headlines

- Canadian oil prices are poised to strengthen next year as Mexican heavy crude exports to U.S. Gulf Coast refineries dwindle, according to BMO Capital Markets. Heavy Western Canadian Select's discount to the West Texas Intermediate benchmark could narrow to $5 to $7 a barrel next year, BMO said in a report Wednesday. Oil sands producers will benefit from less output of competing crude from Latin America as Petroleos Mexicanos expects to cut exports while Venezuelan supplies remain off limits due to U.S. sanctions. Western Canadian Select discount to WTI strengthened to less than $10 a barrel since mid-April, after more than a million barrels a day of oil sands production was shut due to the Covid-19 pandemic. The strong differential has remained near $10 even as oil sands supplies have returned to the market.

- Canada's Sun Life Financial Inc. said it agreed to to buy 51% of Crescent Capital Group for as much as $338 million, bolstering its asset management business with one of the largest investors in alternative credit. Crescent, which is based in Los Angeles and manages about $28 billion, is a major player in senior loans, junk bonds, buyout financing and direct lending to private equity-backed companies. Co-founders Mark Attanasioand Jean-Marc Chapus will retain control of day-to-day operations for five years, at which point Sun Life may acquire the remaining 49%, according to a statement today. The talks were first reported by Bloomberg in August.

October 22nd Mac Os Catalina

World Headlines

- European stocks tumbled for a fourth session, sinking to a three-week low, as investors weighed a stream of corporate earnings, the jump in virus cases across the region and the possibility of U.S. election interference. The Stoxx Europe 600 Index fell 0.5% by 9:26 a.m. in London. Technology and healthcare were among the biggest decliners. British Airways owner IAG SA plunged after warning it won't break even based on cash flow in the fourth quarter. Atlas Copco AB retreated 1.7% after third-quarter orders missed estimates. Investors remain worried about Covid-19 spreading across the region as Germany joined Italy in reporting another record gain in infections, and France and Spain became the first countries in Western Europe to pass 1 million cases. Concerns about the U.S. election are also contributing to the risk-off mood Thursday after the top U.S. spy chief accused Iran of making its most direct efforts to interfere in the closing days of the presidential campaign.

- U.S. futures and European stocks pared losses as investors weighed positive corporate earnings with delays in an economic aid package and rising coronavirus cases. Tesla Inc. climbed in pre-market trading after the electric carmaker reported a fifth consecutive quarter of profits. Luxury handbags and scarves house Hermes International rose after surpassing analysts' sales estimates on a rebound in demand from Asia. U.S. shares closed lower on Wednesday after a volatile session amid signs that a stimulus package is unlikely to become law before the election. House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin made progress in their latest talks and will speak again Thursday even as the odds remained long for a deal that could pass in the Senate.

- Oil held near $40 a barrel in New York after the biggest drop in two weeks on Wednesday following a surprise jump in U.S. gasoline stockpiles and slowing demand. Motor fuel inventories last week rose the most since May and a measure of the fuel's consumption slid to the lowest level since late September, according to government data. Oil is being held in a tight band by a resurgent coronavirus that is threatening demand. At the same time, additional supply is flowing from Libya while the Organization of Petroleum Exporting Countries and its allies are debating if they should follow through on their plan to raise output from January. The group this week warned of a 'precarious' market outlook.

- Gold edged lower after hopes for a pre-election U.S. stimulus package faded, while rising virus cases in Europe continued to hurt sentiment. Republican members Wednesday raised concerns about both the size of the deal under negotiation and policy issues in the language, with some senior lawmakers skeptical the chamber would vote on one even after the election. Talks between House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin continue Thursday, though may be fruitless if the White House can't bring its senators onside. Bullion's negative correlation with the greenback has strengthened in the past month as investors track Washington's to-and-fro wrangling over coronavirus relief, leaving the metal trapped in a tight range. It may stay there until the November election, which could vastly change expectations for fiscal action from the U.S.

- Poland joined Germany, Hungary and Romania in reporting a record gain in coronavirus infections, while Spain and France became the first countries in Western Europe to pass 1 million cases. India's government is budgeting $7 billion to vaccinate the nation's 1.3 billion people. AstraZeneca Plc and Johnson & Johnson may resume U.S. trials as soon as this week after the companies previously halted testing when participants fell ill.

- House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin will pick up discussions of a stimulus package again Thursday with time running ever shorter for a deal before the election and President Donald Trump seeking to blame Democrats for any failure. The two sides 'are better prepared to reach compromise on several priorities' after Wednesday's call between the main negotiators, Pelosi spokesman Drew Hammill tweeted. Pelosi and Mnuchin will speak again Thursday as they seek to 'resolve open questions,' he said. Senate Republicans remain the ultimate roadblock to enacting a roughly $2 trillion deal being negotiated by Pelosi and Mnuchin. Senate Majority Leader Mitch McConnell has made no promises on when the Senate might take up any compromise agreement, and some senior GOP lawmakers expressed skepticism whether the chamber would vote on one even after the election.

- SCG Packaging Pcl, Thailand's biggest packaging maker, climbed in its trading debut after raising about $1.3 billion in an initial public offering priced at the top end of a marketed range. The shares climbed from the offering price of 35 baht to as high as 37.25 baht before trading at 36 baht as of 10:04 a.m. in Bangkok. SCG Packaging's initial share sale was Thailand's second largest this year after Central Retail Corp.'s $2.5 billion offering in February. King Maha Vajiralongkorn is the biggest shareholder of SCG Packaging's parent Siam Cement Pcl with a 33.64% stake, according to the company's website. The packaging company plans to use funds raised from the offering to expand its business, finance new acquisitions and repay debt, according to its filing. Its net income in the first half of this year jumped 40% to 3.64 billion baht ($117 million) from a year earlier, while total sales climbed 11% to 45.9 billion baht.

- Pension Insurance Corporation Plc is to take over a British steel workers pension fund that became embroiled in a financial mis-selling scandal in a 2 billion-pound ($2.6 billion) deal. The insurer will handle the retirement savings for more than 30,000 members of the Old British Steel Pension Scheme, according to a statement Thursday. The plan was rescued by the industry-backed Pension Protection Fund after previous British Steel owner Tata Steel ran into financial difficulties in 2016. Since then, several parliamentary and regulatory inquiries found that many of the fund's members were encouraged by financial advisers to move their pension pots into high-risk, high-fee investments, some of which later collapsed. That led to tighter rules around how savers could move pension money and the quality of advice they should expect.

- The top U.S. spy chief accused Iran of making its most direct efforts to interfere in the closing days of the presidential election, saying the Islamic Republic faked a series of intimidating messages to Democratic voters. John Ratcliffe, the director of national intelligence, said both Iran and Russia had obtained voter registration information and that Tehran was already using it to send threatening emails. The spy chief — a loyal ally of President Donald Trump — didn't provide details of what Russia may have been up to, but he said the Iranian effort was meant to undermine Trump, without explaining how he reached that conclusion. The hastily arranged Wednesday night announcement by Ratcliffe and FBI Director Christopher Wray drew bipartisan warnings against foreign interference and added to the turbulence in Americans politics less than two weeks before the Nov. 3 presidential election.

- One of France's biggest energy companies has delayed a decision on a $7 billion deal to import liquefied natural gas from the U.S. after pressure from the government in Paris to seek cleaner supplies of the fuel. Engie SA said it has postponed work on a contract to take LNG from NextDecade Corp.'s operation, which is fed by shale gas fields using controversial fracking technology. The contract would run through 2045 and is key to launch construction of the U.S. firm's Rio Grande LNG export terminal in Texas, according to the pressure group Les Amis de la Terre. Engie's board has decided to consider a potential contract with NextDecade at a later stage as it needs a 'deeper' examination, said a spokesperson for the utility. She declined to elaborate on the postponement.

- Southwest Airlines Co. is in talks to restructure its orders for Boeing Co.'s grounded 737 Max as the carrier evaluates its fleet needs amid weak demand because of the coronavirus pandemic. The 34 Max planes already in the airline's fleet probably won't resume service until the second quarter of 2021, Southwest said in a statement Thursday as it reported quarterly results. The company didn't say if it would seek to defer deliveries of additional planes, pare orders or make other changes. A restructuring of Southwest's orders would complicate the outlook for Boeing's best-selling jet as the planemaker works with regulators to return the model to the skies, a milestone that could come as soon as this year. The Max has been banned since March 2019 after two crashes killed 346 people.

- AT&T Inc. exceeded profit and wireless-subscriber estimates despite ongoing satellite-TV customer losses and the negative financial effects of the Covid-19 pandemic. The company posted third-quarter adjusted earnings of 76 cents a share and a gain of 1 million regular monthly wireless subscribers, while it lost 590,000 pay-TV subscribers as customer migration to online streaming services continues to take a toll. Analysts predicted earnings, excluding one-time items, of 75 cents a share, and a loss of 890,480 TV subscribers.

- The relentless march of the Covid-19 pandemic and imminent, closely-fought U.S. elections forced credit on the back foot on Thursday, leaving safe-haven deals to dominate Europe's primary bond market. European corporate default risk climbed to the highest in a week as Spain and France became the first nations in western Europe with 1 million coronavirus cases and new infections in Germany jumped to a record. Worries about a delay to U.S. economic stimulus also helped sour the market mood. Rising credit risk is driving demand for safe-haven assets and Italy's offering on Thursday of a 30-year bond saw around 80 billion euros ($95 billion) in orders. It follows Tuesday's European Union sale that saw a whopping 233 billion euros of investor bids.

- Covid-fueled demand for hygiene products and comfort foods is helping Unilever and other consumer-product giants bounce back from years of sluggish growth. The maker of Ben & Jerry's ice cream and Lifebuoy soap reported a 4.4% increase in underlying sales for the third quarter, more than double the consensus analyst forecast. The strong performance echoes results from other makers of food and cleaning products, with Procter & Gamble Co. earlier this week raising its earnings forecast and Lysol maker Reckitt Benckiser Group Plc saying revenue through 2020 will increase by the most in at least a decade. Nestle SA reported strong sales of Purina pet food.

- India's government has set aside about 500 billion rupees ($7 billion) to vaccinate the world's most populous country after China against the coronavirus, according to people with knowledge of the matter. Prime Minister Narendra Modi's administration estimates an all-in cost of about $6-$7 per person in the nation of 1.3 billion, the people said, asking not to be identified as the details are private. The money provisioned so far is for the current financial year ending March 31 and there will be no shortage of further funds for this purpose, they added.

- Japan will promote the use of offshore wind generation and battery storage in its new effort to become carbon neutral by 2050, according to a government official, indicating how the nation might change its policies to meet the ambitious goal. The world's fifth-biggest greenhouse gas emitter, which is expected to formally announce the emissions pledge Monday, is aligning itself with commitments made by other major economies including the European Union and China, after lagging peers through its continued reliance on coal, the dirtiest fossil fuel. 'Japan's leadership seems to have become more sensitive to the country's reputational standing in the global climate diplomatic arena,' Jane Nakano, a fellow at the Center for Strategic and International Studies, said by email.

- Huawei Technologies Co. quietly spent months racing to stockpile critical radio chips ahead of Trump administration sanctions, ensuring it can keep supplying Chinese carriers in their $170 billion rollout of 5G technology through at least 2021. Partner Taiwan Semiconductor Manufacturing Co. began ramping up output in late 2019 of Huawei's 7-nanometer Tiangang communications chips, the most crucial element in 5G base stations, people familiar with the matter said. The Taiwanese contract manufacturer eventually shipped more than 2 million units at Huawei's behest ahead of the sanctions cutoff last month, one of the people said, asking not be identified discussing internal matters. The sheer magnitude of orders at one point got TSMC executives wondering whether they had underestimated global demand, the person said.

- Thai Prime Minister Prayuth Chan-Ocha ordered the withdrawal of the week-old state of emergency in the nation's capital that barred large gatherings, in a bid to pacify pro-democracy protesters calling for the resignation of his government and monarchy reform. The move follows a de-escalation in the situation that allows authorities to use existing laws to manage protests, according to a notification signed by Prayuth in the Royal Gazette. While the main organizers didn't stage formal rallies on Thursday, hundreds of protesters gathered in several locations across Thailand. Free Youth, one of the main protest organizations, said via Telegram that even though the emergency rules have been lifted, the government still had not responded to any of the key demands. The organization said it will intensify its agitation if the prime minister didn't resign in three days, and was preparing to call another mass gathering.

- Goldman Sachs Group Inc.'s Asian unit was fined $350 million by Hong Kong's financial regulator over its role in Malaysia's 1MDB investment-fund scandal. The U.S. bank was 'reprimanded' for 'serious lapses and deficiencies in its management supervisory, risk, compliance and anti-money laundering controls,' the Securities and Futures Commission said in a statement. Goldman Sachs Asia's acceptance of the SFC's findings and disciplinary action facilitated an early resolution of the matter, it said. Goldman is also poised to reach a long-awaited pact with the U.S. Department of Justice to pay more than $2 billion to resolve a criminal investigation into the bank's role in the 1MDB scandal, people familiar with the matter told Bloomberg News this week.

- The State Department approved $1.8 billion in new arms for Taiwan and submitted the package to Congress Wednesday for a final review in a move aimed at improving the island's self-defense capabilities against a long-threatened invasion by China. The package includes 135 SLAM-extended-range land attack missiles from Boeing Co. valued at $1 billion if the entire sale goes through, $436 million for Himars mobile artillery rocket systems made by Lockheed Martin Corp.and $367 million in surveillance and reconnaissance sensors from Raytheon Technologies Corp. to be mounted on aircraft. The submission to Congress for a 30-day review, which is unlikely to draw opposition, comes two months after the U.S. and Taiwan completed the sale of 66 new model F-16 Block 70 aircraft from Lockheed.

- Ask Moderna Inc. bulls how the money-losing biotech firm has just become a $28 billion stock, and they'll play up its status as a frontrunner to deliver a drug that ends the pandemic. While the company holds equipment and cash, what makes investors so willing to shell out is its promise in research and development. Yet under rules established since 1975, accountants treat R&D not as an asset of identifiable value on the balance sheet, but as an expense that reduces corporate earnings. Now, big Wall Street names are pushing back. From MFS Investment Management to Wellington Management, they're shaking up their investing models to make it easier to evaluate a Corporate America built on intangible assets — brands and patents — rather than physical items like factories and commodities.

- Wall Street's fear gauge is poised to tumble to pre-pandemic levels in the aftermath of a clear-cut election victory for Joe Biden even if U.S. stocks decline in its wake, according to Barclays Plc. In projections more aggressive than the futures market is pricing in, the Cboe Volatility Index will likely drop to 'at least' 20 if a win for the Democratic contender is confirmed shortly after the Nov. 3 vote, the bank told clients this week. While stock traders have turned bullish on the growing likelihood of a Blue Wave, markets remain on high alert for prolonged post-election uncertainty. The November VIX future, which expires two weeks after the vote, is trading at 29, around current levels of the spot index. A level of 30 implies the S&P 500 Index will move around 9% over the next 30 days, according to analytics service SpotGamma.

- Coca-Cola Co. sales are inching back toward normal, even as it warns surging virus cases could continue to muddle near-term results. 'While many challenges still lie ahead, our progress in the quarter gives me confidence we are on the right path,' Chief Executive Officer James Quincey said. Global unit case volume was down 4% as the restaurants and entertainment venues that make up about half of revenues aren't yet back to normal. Still, that's far better than the previous quarter when volume fell 16%. Some increase in at-home consumption has helped offset the problems in public spaces.

- The U.S. monopoly case against Alphabet Inc.'s Google is likely to trigger an onslaught of private antitrust lawsuits riding on the allegations in the government's complaint. The deluge of litigation has the potential to force the search giant to pay billions of dollars in settlements, according to legal experts. The Justice Department's case filed Tuesday will be 'followed by a wave of private cases,' said Patrick J. Coughlin, a lawyer who has represented consumers in class actions against companies such as Apple Inc., Visa Inc. and MasterCard Inc. 'Every antitrust law firm in the country will be involved in some way or another.'

- When then-Walt Disney Co. executive Kevin Mayersat down with Hans Vestberg, the soon-to-be chief executive officer of Verizon Communications Inc., at the 2018 Sun Valley conference in the Idaho mountains, it was supposed to be a get-to-know-you chat. The annual conclave of media and tech heavy hitters is known as a place where deals are hatched—and this meeting didn't disappoint. Mayer was plotting the launch of Disney+, the company's big effort to compete with Netflix Inc. in the business of online video. Their talk set the stage for Verizon, the largest U.S. wireless carrier, to provide the service free of charge for one year to many of its mobile phone and internet customers. The offer gave the streaming service a boost when it premiered in November 2019, with Disney reporting more than 26 million subscriptions in the first two months, 20% of them from Verizon.

October 22nd Mac Os Download

*All sources from Bloomberg unless otherwise specified This is not a happy story (demo) mac os.